The Federal Budget for FY2024-25 has been unveiled, and it’s being touted as one of the most ‘friendly’ budgets in recent times. But as we dive into the details, it becomes clear that the benefits might not be reaching the common people as expected. Let’s break down the key points of the budget and see who really benefits.

Total Outlay and Major Allocations

The total outlay for the budget is Rs. 18,877 billion. Here’s a look at the major allocations:

- Debt Servicing: A staggering Rs. 9,700 billion is allocated for debt servicing. This is more than half of the total budget, highlighting the significant burden of debt on the country’s finances.

- Defence: The defence budget has been increased to Rs. 2,100 billion. While national security is crucial, this allocation raises questions about the balance between defense spending and other critical needs.

- Public Sector Development Program (PSDP): Rs. 1,150 billion has been allocated to the PSDP, aimed at various development projects across the country.

- Subsidies and Pensions: The budget for subsidies and pensions has been increased by 42% and 20%, respectively.

Sector-Specific Allocations

- Education: Only Rs. 93 billion has been allocated to education. In a country with a significant youth population needing quality education, this amount seems insufficient.

- Health: National health projects have been allocated Rs. 24 billion. Given the ongoing health challenges, this budget is quite low.

- Energy Projects: Rs. 378 billion is earmarked for energy projects to address infrastructure needs.

- Infrastructure: Rs. 877 billion has been set aside for infrastructure, including roads, bridges, and other critical projects.

Relief Measures and Fiscal Policies

- Salary and Pension Increases: Government employees’ salaries have been increased by 35%, and pensions by 17.5%. The minimum wage has also been raised to Rs. 37,000 per month. These measures are steps in the right direction, but whether they are enough to counteract inflation remains to be seen.

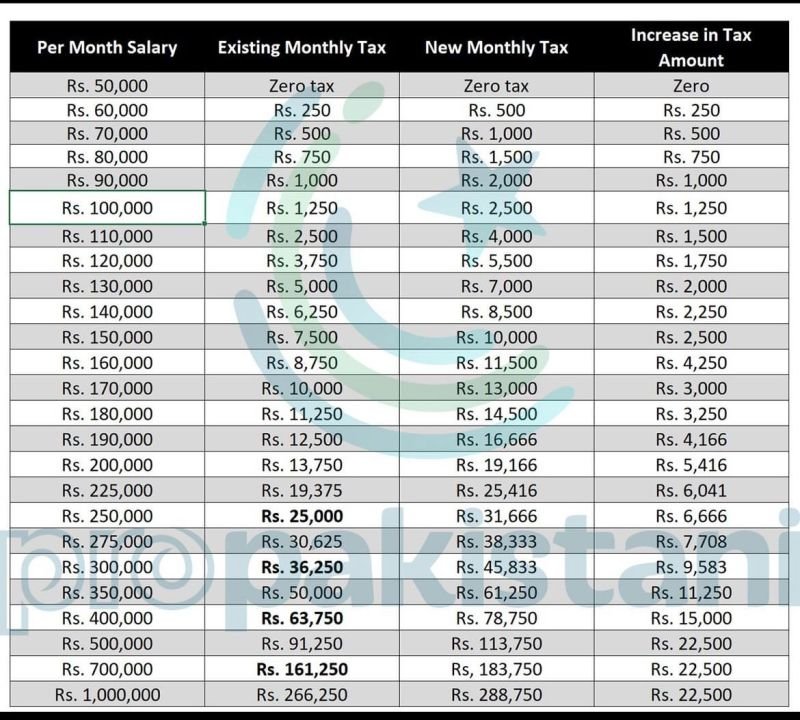

- New Taxes: The budget introduces a standard 18% sales tax on previously exempted items. This move aims to increase revenue but could also burden the average consumer.

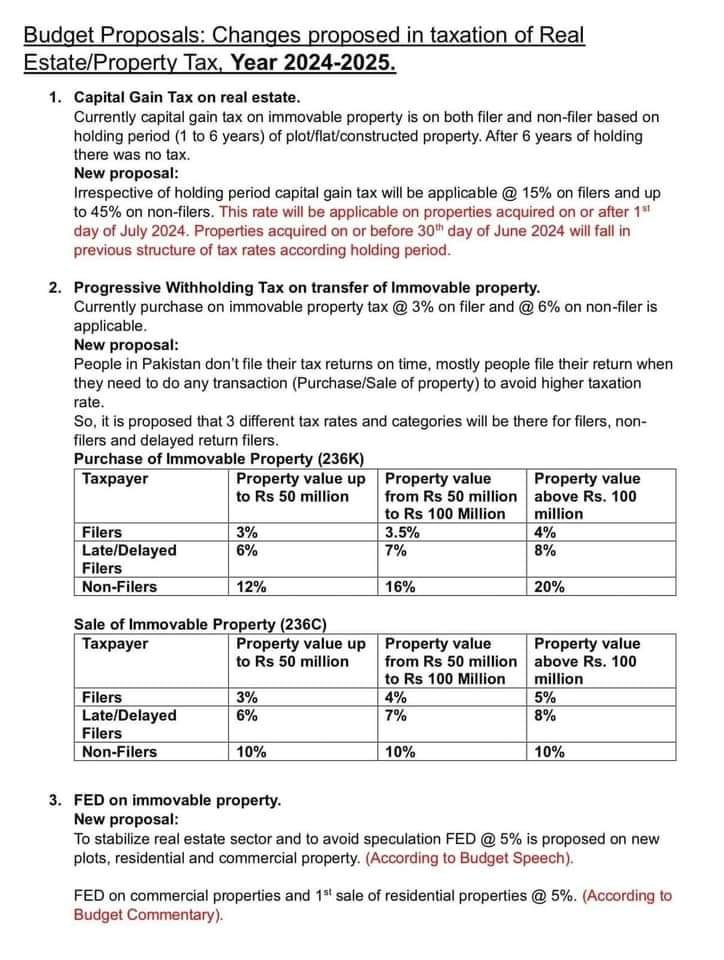

New Taxes On Real Estate Property Pakistan

While the 2024-2025 budget showcases impressive numbers and friendly labels, it’s essential to scrutinize the allocations to understand who truly benefits. The needs of the common people seem overlooked in favor of broader economic and security concerns. As citizens, it’s vital to stay informed and hold our leaders accountable to ensure that the budget serves everyone’s interests.